Legal spend management: how to reduce your legal spending

Legal spend management is the practice of tracking, analyzing, and optimizing costs incurred by your in-house legal departments and their outside counsel. It involves creating and maintaining systems to keep track of where you spend your money and identifying opportunities to control costs.

By introducing a better legal spend management strategy in your organization, you can reduce your legal spending and save up to 26% on accrual estimates. A centralized database, automated billing, a dedicated budget, and clear key performance indicators (KPIs) to measure vendor performance will help you achieve this goal.

Centralize spend data

When your spend data exists in a central location, it’s easier to analyze your data and spot trends/opportunities in spend. If your data is scattered over multiple applications, your team will have to switch between apps when working with data, resulting in increased chances of human error and reduced productivity. Having centralized data means consistency, security, faster reporting, improved strategies, and better execution of plans.

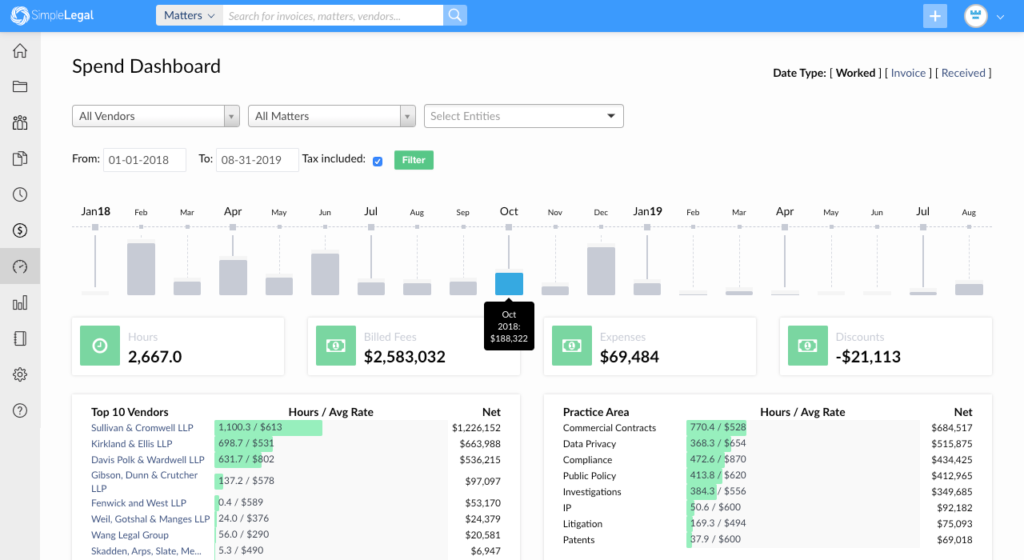

The best place to house all your spend-related data is in legal spend management software. Legal spend management solutions are cloud-based platforms that allow general counsels and in-house legal ops professionals to monitor and manage their matters, vendors, spend, and documents, as well as create reports and more from a special dashboard.

So, instead of using Microsoft Excel to maintain spreadsheets, Tableau for data visualization, and QuickBooks for invoice management, you will be using one software application that will deal with all of it.

Some spend management solutions also allow you to request budgets from outside counsel plus track and approve invoices. That way, you’ll have records of your budgets in addition to actual spend if you need to analyze your spend to budget in the future.

Set a legal department budget

Budgets help you benchmark and control spend with ballpark figures. Once you are operating within a budget, you start to question how much certain vendors cost and whether or not they are earning their keep.

Follow these steps to set useful budgets for your legal department:

- Look at expenses from previous years to set ballpark figures/estimates – Annual administrative fees (e.g., corporate filing fees) and preexisting alternative fee arrangements (e.g., flat fees) will stay the same, so it’s safe to budget those at the same amounts. For the rest, you can use current and past estimates. This initial budget is meant to serve as a starting point you’ll continue to tweak.

- Talk to people from other departments to spot issues that may affect spend – Some common scenarios that may give rise to new fees include new products that’ll need patent filings, trademarks from the product department, joint ventures, or partnerships in marketing and promotion.

- Talk to outside counsel to get estimates for predicted tasks – Ask your vendors what the costs for upcoming matters would look like.

By looking at historical data and talking to vendors and stakeholders, you can create a budget that accounts for recurring as well as predicted and one-off legal matters.

Set up and enforce billing guidelines

Set up billing guidelines to mitigate surprise fees, unauthorized charges, vague line items, and late invoices and share them with your vendors. This will ensure you only get charged for what’s due and when it’s due, so your monthly budget doesn’t get thrown off. Your guidelines will also give your department a set of standards to follow during invoice review. If a vendor’s invoice doesn’t meet your guidelines, your team can return it to the vendor and ask for specific changes.

Your billing guideline should include:

- An introduction – A brief rundown of the going-into-effect date of your billing guidelines and a statement of your right to modify or reject invoices that don’t follow the guidelines.

- Staffing information – Details about who’s in charge of hiring, DE&I tracking, appropriate staffing levels for certain projects or task types, and the approval process for staffing changes. The goal is to dictate the appropriate staff level for tasks, so you don’t pay partner-level rates for tasks that can be completed by a paralegal or an associate.

- Invoicing and billing procedures – Details about how outside counsel should submit invoices (through a legal e-Billing platform, for example) and how to format those invoices. For example, include matter name and ID, then a description of work, then timekeeper name, title, rate, etc. This is also a good place to state billing codes to encourage task-based billing and accuracy.

- Timing requirements – Information on the appropriate time to send an invoice. For example, not more than two weeks after work is completed.

- A signature page – To sign the agreement and indicate consent of all parties involved.

Once set up, you should be able to enforce billing guidelines in your e-Billing software. Software should make every step of your e-Billing workflow simple and seamless.

Automate billing

Automated billing reduces overbilling by avoiding manual billing errors, such as not sending the invoice on time, using the wrong name on the invoice, not itemizing services correctly, and so on. The most effective way to automate billing is to use e-Billing software. We’ve seen customers save an average of 8.4% in legal spend thanks to e-Billing.

Look for an e-Billing software with the following capabilities:

- Metrics tracking – So you can easily analyze and optimize legal spend beyond auto-billing.

- Easy reporting – The ideal e-Billing software will have robust reporting capabilities that let you filter metrics to create useful reports in a few clicks.

- Free training and support – Check for responsive customer support and extensive training material on how to use the platform. One of the best ways to sample customer support and training is to sign up for a free demo of the software.

- Pre-built integrations – You’ll need to integrate with your existing apps, such as Outlook, IPfolio, or iManage, for example, so you don’t duplicate your entries.

Monitor spend and vendor performance

Monitor spend and vendor performance to find opportunities to control costs and reduce spend. Specifically, create a view that compares your spend across vendors against their performance to determine which vendors generate the best returns. This will help you reduce spend without affecting service quality.

Tracking spend is easy: you can likely track your spend on each vendor by project, quarter, and year in a spreadsheet. Vendor performance is a different story. You will need KPIs based on your priorities.

The majority of legal ops departments track total spend, vendor or attorney billing rate, and spending broken out by matter, project, or task. Many legal teams also track across a series of KPIs such as:

- Cost per lawyer

- Cost per matter

- Matters per lawyer

- Budget vs. actual spend

- Success ratio for cases solved

- Time taken to resolve matters and disputes

You can also go for qualitative KPIs and survey your in-house counsel to collect feedback on your active vendors. Use their responses to grade each of your vendors on the KPIs you find most important. This feedback becomes hard data that quantifies vendor performance, which you can compare against your vendor spend data to see which vendors are delivering adequate value and which aren’t.

Tracking and reporting on DE&I can help you manage your spend on these important initiatives and measure your success.

You can track this data in a spreadsheet, but legal spend management software will make your life much easier.

A good dashboard view will show you an overview of your top vendors and practice area, among others. From there, you can filter to find specific data you want.

Make spend decisions based on past data

As you’re tracking your legal spend over time, you’re creating a record of past expenditures that you can use to inform your decision-making. Based on your past spend analytics, you get a clear view of how your money is allocated within legal operations. Other department leaders and C-suite executives can also rely on your spend management system to help them craft company-wide budgets.

A spend record is important for cost predictability. When you’re setting your departmental budget, you need to understand how much your team typically spends on each matter or legal service.

Spend records are also useful for spotting trends within your department. For example, perhaps your department routinely spends more funds in IP matter management than in other practice areas. That data aberration could have a number of explanations, like the need for additional staff training in IP matters or third-party spending on outside counsel that is too expensive for your department. Your spend record points to red flags that your department is potentially overspending—so you have an opportunity to address the issue and uncover cost savings.

Your past spend analytics can also keep you ahead of industry trends for corporate legal departments. Overall, legal spending trended up in 2021, and industry experts expect costs to grow, particularly in a few key areas:

- M&A

- Contracts

- Cybersecurity

- Data privacy

- Regulatory matters

As long as you have a clear picture of your spend data and you can monitor and reallocate spending in real time, you can make agile changes based on the way the industry is heading. That flexibility and control is the heart of data-informed decision-making.

Legal spend management software will save you time, headaches, and dollars

Legal spend management is your best line of defense against rising legal costs, but it can be complex to do manually. With the right tool and the right process, legal spend management becomes easy.

Consider using a spend management solution like SimpleLegal to improve efficiencies and reduce your legal spend.

This article has been updated to reflect new information and industry trends from the original article, published on October 15, 2021.