What legal ops should know about monthly accruals in 2021

Many in-house legal teams are familiar with accruals, also known as unbilled estimates or the amounts that law firms estimate for work in progress. Unfortunately, unbilled estimates are difficult to collect, inaccurate more often than not, and almost impossible to track from submission to payment when manual processes are in place.

Shockingly, only 28% of legal departments use technology to automate accruals management. In 2021, highly manual and error-prone accruals management simply won’t cut it. The majority of legal ops executives name cost control a top priority for the coming year, so accurately and efficiently forecasting costs is crucial.

Accruals management challenges

Many legal teams are familiar with accrual estimates and pending invoices, which are the most common types of accruals, but there are actually four types of accruals in legal: accrual estimates, pending invoices, invoices with missing information, and rejected invoices.

Of course, identifying the different types of accruals is only one aspect of the process. Our internal study revealed additional challenges.

Only 48% of law firms respond to requests for unbilled estimates

Legal and finance cannot accurately forecast spend if they don’t receive unbilled estimates from the outside firms they work with. Unfortunately, nearly half of law firms simply do not respond to monthly accrual requests.

Low response rates often boil down to two main issues: law firms don’t understand how to calculate accruals, or they don’t know how to submit unbilled estimates to legal ops and finance. Your legal ops team should get ahead of these struggles by clearly defining a process for collecting monthly accruals and providing training for each law firm.

There is a 26% discrepancy between accrual estimates & amounts actually invoiced by law firms

Improving response rates is an important step, but our study also showed that there’s often a wide gap between the unbilled estimates law firms provide and the invoices they end up sending.

Not only does the 26% discrepancy translate to hundreds of thousands of dollars, but it also leads to a domino effect of manual work. When finance is surprised by a large invoice, the department has to reach out to legal ops, and then legal has to communicate with the outside law firm to try to figure out what happened between planning the budget and submitting the invoice.

Let’s say a law firm submits monthly accrual estimates for $50,000 in work but ends up billing $63,000. Finance flags the additional costs but isn’t familiar enough with the work to really dig into the discrepancy. So, legal ops steps in and discovers that the outside firm billed several hours of associate-level work at partner timekeeper rates. Legal ops then has to go back to the outside firm to dispute the invoice. Sounds pretty exhausting, right? And with a manual system, this process would eat up so much time and labor costs that many companies would simply absorb the costs. But imagine multiplying that extra $13,000 by 20 law firms.

Rejected invoices & missing information are often overlooked

These two types of accruals can cause a lot of legal accruals management issues because many companies don’t have a solid process in place to keep track of them.

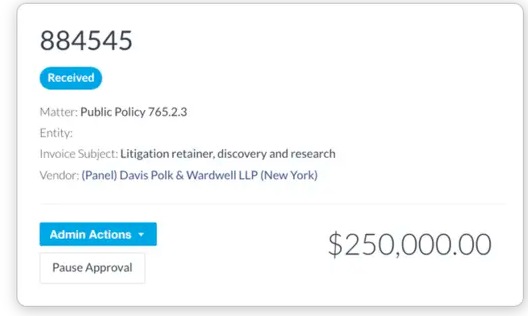

Finance doesn’t work closely with outside firms, so they don’t always know what should be included in invoices. Even if they realize data is missing, manual processes make it difficult to track estimates associated with incomplete invoices. With a spend management platform like SimpleLegal, not only can you add approvers at each stage of invoice review, but you can also put invoices on hold.

Use SimpleLegal invoice approval workflow to pause approval on invoices that require additional review.

Rejected invoices can throw off accrued cost estimates as well. With a manual system, if an invoice is rejected by a law firm or flagged by your internal team, there’s no record of those accrued costs. This complicates and delays the accruals collection process and makes it difficult to produce accurate accounting records.

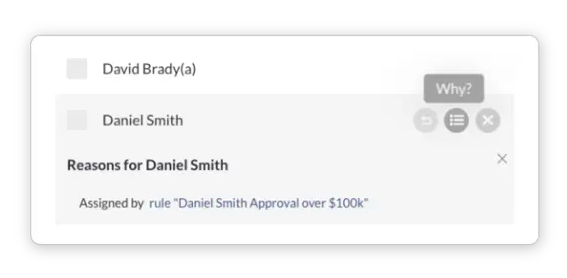

SimpleLegal makes the process more intuitive by automatically routing flagged invoices to the proper person for review. The system includes a “Why” section so that if an invoice ends up in someone’s hands, they know exactly why it’s been sent to them for review and approval.\

Use SimpleLegal to automatically add explanations for why an invoice needs to be reviewed by a specific approver.

This additional oversight can go a long way in closing that 26% gap between monthly accruals estimates and amounts invoiced.

Legal ops should own the accruals management process

Although finance should be consulted, the legal ops team is better suited to design and manage the accruals process for outside firms. They’re better positioned than finance to review invoices before payment because they work closely with law firms and are more in-tune with the work that’s being done.

Interested in learning more? Download our white paper, Beginner’s Guide to Accruals Management for Legal Departments, and learn how to effectively collect unbilled estimates, work closely with finance and your law firms to produce accurate results, and replace outdated manual processes with automation from e-Billing.