2021 Guide to UTBMS Codes and ABA Codes

The Uniform Task-Based Management System (UTBMS) details a series of code sets that law firms use to classify services on electronic invoices that they send to clients, such as legal operations and corporate legal departments.

UTBMS codes make detailed spend reporting possible by ensuring that each task and expense is categorized. That way, when you notice in Q1 that spending is out of control, you’re able to identify and solve the problem before Q4. Of course, in order for reporting to be accurate, you must first fully understand UTBMS codes and how to use them.

What are UTBMS codes?

UTBMS codes are a set of codes originally developed by the American Bar Association (ABA), the Association of Corporate Counsel (ACC), and PricewaterhouseCoopers (PwC). Now, UTMBS standards are maintained by the Legal Electronic Data Exchange Standard (LEDES) Oversight Committee, also known as LOC.

The creators designed UTBMS Codes to standardize the categorization of legal services and expenses so that legal work and the associated costs could be easily identified and analyzed. You can learn more about the LEDES file format and LOC here (https://www.simplelegal.com/blog/ledes-file-format-defined).

UTBMS codes are used in many legal systems around the world, including the United States, Canada, and the United Kingdom. For this article, we will focus on UTBMS standards for e-Billing set by the ABA and LOC.

American Bar Association UTBMS codes

When used consistently and properly, ABA UTBMS task codes allow you to monitor legal spending and associated activities.

All ABA UTBMS codes are broken into categories and phases. Categories are identified by the beginning letter (e.g., L for ABA litigation codes) while phases are specified by the number (100s for phase 1, 200s for phase 2, etc.). While some UTBMS codes are fairly self-explanatory, others require a deeper explanation. We’ll walk you through all of the ABA UTBMS codes, and provide more insight when necessary.

Activity

Activity codes identify the type of activity associated with a cost.

- A101 Plan and prepare for

- A102 Research

- A103 Draft/revise

- A104 Review/analyze

- A105 Communicate (in firm)

- A106 Communicate (with client)

- A107 Communicate (other outside counsel)

- A108 Communicate (other external)

- A109 Appear for/attend

- A110 Manage data/files

- A111 Other

Although not all clients require the use of UTBMS activity codes, this code set is useful for segmenting specific types of work. For instance, the four separate communication codes ensure more accurate spend tracking for both the counsel and the client. In situations where you may need to consult with an expert as well as outside counsel, codes A108 and A107, respectively, would allow you to categorize time spent on each type of communication.

Bankruptcy

Derived from the code set published by the U.S. Department of Justice, bankruptcy UTBMS codes are intended only for bankruptcy matters. All adversarial tasks are covered by the litigation code set. The 21 bankruptcy ABA task codes are broken up into four phases.

B100 Administration

UTBMS codes in the B100 phase include administrative work during preparation, such as research, fee applications, and communication with creditors.

- B110 Case Administration: Preparation of coordination and compliance matters, financial affairs statements, and general creditor inquiries

- B120 Asset Analysis and Recovery: Identification and review of potential assets including causes of action and non-litigation recoveries

- B130 Asset Disposition: Sales, abandonment and transaction work related to asset disposition

- B140 Relief from Stay/Adequate Protection Proceedings: Matters relating to termination or continuation of automatic stay under 362 and motions for adequate protection

- B150 Meetings of and Communications with Creditors: Preparing for and attending the conference of creditors, the 341(a) meeting and other creditors’ committee meetings

- B160 Fee/Employment Applications: Preparations of employment and fee applications for self or others; motions to establish interim procedures

- B170 Fee/Employment Objections: Review of and objections to the employment and fee applications of others

- B180 Avoidance Action Analysis: Review of potential avoiding actions under Sections 544-549 of the Code to determine whether adversary proceedings are warranted

- B185 Assumption/Rejection of Leases and Contracts: Analysis of leases and executory contracts and preparation of motions specifically to assume or reject

- B190 Other Contested Matters (excluding assumption/rejection motions): Analysis and preparation of all other motions, opposition to motions and reply memoranda in support of motions

- B195 Non-Working Travel: Non-working travel where the court reimburses at less than full hourly rates

B200 Operations

B200 codes cover business matters, such as document review, employee benefits, cash collaterals, real estate, and tax issues.

- B210 Business Operations: Issues related to debtor-in-possession operating in chapter 11 such as employee, vendor, tenant issues and other similar problems

- B220 Employee Benefits/Pensions: Review issues such as severance, retention, 401K coverage and continuance of pension plan

- B230 Financing/Cash Collections: Matters under 361, 363 and 364 including cash collateral and secured claims; loan document analysis

- B240 Tax Issues: Analyses and advice regarding tax-related issues, including the preservation of net operating loss carry forwards

- B250 Real Estate: Review and analysis of real estate-related matters, including purchase agreements and lease provisions (e.g., common area maintenance clauses)

- B260 Board of Directors Matters: Preparation of materials for and attendance at Board of Directors meetings; analysis and advice regarding corporate governance issues and review and preparation of corporate documents (e.g., Articles, Bylaws, employment agreements, compensation plans, etc.)

B300 Claims and Plan

The B300 codes are used for all work related to claim inquiries and preparing disclosure statements and business plans.

- B310 Claims and Administration Objections: Specific claim inquiries; bar date motions; analyses, objections and allowances of claims

- B320 Plan and Disclosure Statement (including Business Plan): Formulation, presentation and confirmation; compliance with the plan confirmation order, related orders and rules; disbursement and case closing activities, except those related to the allowance and objections to allowance of claims

B400 Bankruptcy-Related Advice

All advice, analyses, and consultations related to bankruptcy matters fall under the B400 code set.

- B410 General Bankruptcy Advice/Options: Analysis, advice and/or opinions regarding potential bankruptcy related issues, where no bankruptcy case has been filed

- B420 Restructurings: Analysis, consultation and drafting in connection with the restructuring of agreements, including financing agreements, where no bankruptcy case has been filed

Counseling

Counseling is one of the broader categories of UTBMS codes. This code set is designed to cover time used by attorneys preparing to provide legal advice. Generally, the counseling ABA task codes do not attribute time to a specific matter. Instead, they serve as a catchall billing code for time spent on research throughout a monthly billing period.

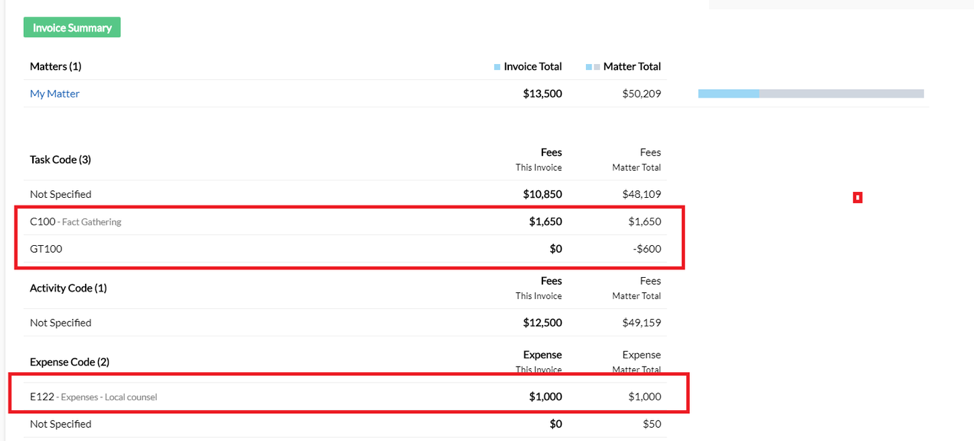

- C100 Fact Gathering: All initial inquiries, meetings, and data/information collection related to the assignment

- C200 Researching Law: Time spent researching relevant case law or general investigation as well as consultations with experts

- C300 Analysis and Advice: Analysis of work performed under C100 and C200 along with providing opinions and advice to client

- C400 Third Party Communication: Discussions with third parties such as regulators or parties to contracts with the client

Expense

Expense UTBMS codes help with budget tracking by categorizing types of spending.

- E101 Copying

- E102 Outside printing

- E103 Word processing

- E104 Facsimile

- E105 Telephone

- E106 Online research

- E107 Delivery services/messengers

- E108 Postage

- E109 Local travel

- E110 Out-of-town travel

- E111 Meals

- E112 Court fees

- E113 Subpoena fees

- E114 Witness fees

- E115 Deposition transcripts

- E116 Trial transcripts

- E117 Trial exhibits

- E118 Litigation support vendors

- E119 Experts

- E120 Private investigators

- E121 Arbitrators/mediators

- E122 Local counsel

- E123 Other professionals

- E124 Other

Expense UTBMS codes are generally combined with a related activity code. For example, an invoice might include activity code A102 paired with expense code E101. A102 categorizes the time spent researching, while E101 specifies money spent on printing copies of that research.

This code set not only facilitates educated budget planning but also simplifies the process of submitting attorney expenses.

Litigation

ABA litigation codes are broken into five phases and encapsulate the entire litigation process.

L100 Case Assessment, Development, and Administration

- L110 Fact Investigation/Development

- L120 Analysis/Strategy

- L130 Experts/Consultants

- L140 Document/File Management

- L150 Budgeting

- L160 Settlement/Non-Binding ADR

- L190 Other Case Assessment, Development and Administration

During the initial stages, L100 codes could be combined with activity UTBMS codes. For example, A106 (Communicate with client) might be paired with L110 or L120 because client communication would help formulate the litigation strategy.

L200 Pre-Trial Pleadings and Motions

- L210 Pleading

- L220 Preliminary Injunctions/Provisional Remedies

- L230 Court Mandated Conferences

- L240 Dispositive Motions

- L250 Other Written Motions and Submissions

- L260 Class Action Certification and Notice

Expense codes often accompany L200 codes, such as E112 (Court fees) associated with filing for class certification (L260) or filing a pleading (L210).

L300 Discovery

- L310 Written Discovery

- L320 Document Production

- L330 Depositions

- L340 Expert Discovery

- L350 Discovery Motions

- L390 Other Discovery

L400 Trial Preparation and Trial

- L410 Fact Witnesses

- L420 Expert Witnesses

- L430 Written Motions and Submissions

- L440 Other Trial Preparation and Support

- L450 Trial and Hearing Attendance

- L460 Post-Trial Motions and Submissions

- L470 Enforcement

This phase also calls for the use of expense fees, such as E114 (Witness fees) when interviewing an expert witness (L420).

L500 Appeal

- L510 Appellate Motions and Submissions

- L520 Appellate Briefs

- L530 Oral Argument

L600 e-Discovery

In 2011, LOC and ABA ratified the litigation codes to include a sixth phase for an e-Discovery code set. Each parent task code has sub-task codes for more granular tracking. To keep this brief, we’ll list only the parent tasks.

- L600 Identification

- L610 Preservation

- L620 Collection

- L630 Processing

- L650 Review

- L660 Analysis

- L670 Production

- L680 Presentation

- L690 Project management

Project

For non-litigation matters, project codes are used for administrative filings, transactions, and stand-alone projects. The project code set includes eight phases.

- P100 Project Administration: All initial administration work such as developing, negotiating, and revising the plan and budget for the matter at hand

- P200 Fact Gathering/Due Diligence

Codes within the P200 phase are used for time spent on fact investigation, document retrieval, and preparation of reports with clients. They also cover coordination with third parties related to these activities.

Each P200 UTBMS code designates time spent on fact investigation/due diligence from a specific perspective, such as tax or environmental.

- P210 Corporate Review

- P220 Tax

- P230 Environmental

- P240 Real and Personal Property

- P250 Employee/Labor

- P260 Intellectual Property

- P270 Regulatory Reviews

- P280 Other

P300-P800 make up the additional codes within this phase.

- P300 Structure/Strategy/Analysis: Time spent on analysis done for the purposes of developing the strategy for a project or transaction. This includes all steps taken to create a written outline or description of the strategy

- P400 Initial Document Preparation/Filing: Tasks performed to prepare documents and opinions before being sent to third parties. This includes filing documents, related communications with the client, and review of client-generated transaction documentation

- P500 Negotiation/Revision/Responses: Time spent negotiating and revising P400 transaction documentation, including all related document review, meetings and client communications

- P600 Completion/Closing: All tasks related to transaction pre-closing and closing, project completion or filing acceptance, such as attendance at closing

- P700 Post-Completion/Post Closing: All post-completion or post-closing tasks such as amendments to final documentation and resolution of post-closing issues. Also includes all implementation tasks (e.g., funds held in escrow) and preparation of closing binders (i.e., primarily clerical actions)

- P800 Maintenance and Renewal: All tasks related to subsequent maintenance and renewal requirements under the terms of the transaction or project such as monitoring of lease agreements, routine waivers and coordination of UCC requirements

Workers’ Compensation

The workers’ compensation code set was not originally included but was defined by a 2010 ratification. Many tasks include a “Commentary & Practice Tips” subset that shares the same code as the parent task. For example, WC 110 could refer to Fact Investigation/Development or the Commentary & Practice Tips related to that task.

This UTBMS code set includes a total of five phases and 27 ABA task codes. For the sake of brevity, we will provide a high-level description of each phase. It’s important to note that the Workers’ Compensation code set does not include phase-level parent tasks (WC 100, WC 200, WC 300, etc.)

WC 100 phase: All actions related to researching the case matter, strategizing, consulting with experts, and settlements.

- WC 110 Fact Investigation/Development

- WC 110 Commentary & Practice Tips

- WC 120 Analysis/Strategy

- WC120 Commentary & Practice Tips

- WC 130 Experts/Consultants

- WC130 Commentary & Practice Tips

- WC 150 Budgeting

- WC 150 Commentary & Practice Tips

- WC 160 Settlement/Resolution

- WC 160 Commentary & Practice Tips

- WC 180 Alternative Fee Arrangements

WC 200 phase: Time spent preparing and filing pleadings, conferences with judge, negotiating alternative fee arrangements.

- WC 210 Pleadings

- WC 210 Commentary & Practice Tips

- WC 230 Conferences with Judge

- WC 230 Commentary & Practice Tips

- WC 280 Alternative Fee Arrangements

WC 300 phase: Time spent on all discovery motions, document production/acquisition, and depositions.

- WC 310 Written Discovery

- WC 310 Commentary & Practice Tips

- WC 320 Document Production/Acquisition

- WC320 Commentary & Practice Tips

- WC 330 Depositions

- WC 330 Commentary & Practice Tips

- WC 334 Deposition Report

- WC 340 Expert Discovery

- WC 340 Commentary & Practice Tips

- WC 350 Discovery Motions

- WC 350 Commentary & Practice Tips

- WC 360 Discovery On-Site Inspections/Visits

- WC 360 Commentary & Practice Tips

- WC 380 Alternative Fee Arrangements

WC 400 phase: Time spent on preparing for and communicating with witnesses, drafting written motions, and preparing for and attending hearings.

- WC 410 Fact Witnesses

- WC 410 Commentary & Practice Tips

- WC 420 Expert Witnesses

- WC 420 Commentary & Practice Tips

- WC 430 Written Motions/Submissions

- WC 430 Commentary & Practice Tips

- WC 440 Hearing Preparation and Support

- WC 450 Hearing

- WC 450 Commentary & Practice Tips

- WC 460 Post-Hearing Conferences/Motions/Submissions

- WC 460 Commentary & Practice Tips

- WC 480 Alternative Fee Arrangements

WC 500 phase: Time spent on all appellate proceedings.

- WC 510 Appellate Proceedings/Motions Practice

- WC 510 Commentary & Practice Tips

- WC 520 Appellate Briefs

- WC 520 Commentary & Practice Tips

- WC 530 Oral Argument

Easily track legal spend by UTBMS code with SimpleLegal

With SimpleLegal, you can easily process invoices using UTBMS codes to help customers better categorize outside counsel activity and track spend at a more granular level. Custom task, activity, and expense codes can also be used if your department leverages them.

When invoices are categorized, you can run standard or ad-hoc reports for matter-level comparisons of legal spend by task code as well as other insights, such as views into spend by tasks for your practice areas or specific vendors. SimpleLegal also provides a Spend Dashboard that quickly identifies your top task codes in use and provides information about average rates and how much was billed to each task code.

UTBMS codes also allow you to enforce billing guidelines and control spending. You can set limits and create warnings associated with specific codes in SimpleLegal’s platform so t expenses can be automatically approved, rejected, or adjusted.

Start using UTBMS codes to streamline spend management

Modern and intuitive, SimpleLegal provides all of the financial tools legal teams need to easily categorize spending, run detailed reports, enforce billing guidelines, and analyze budgets. Schedule a demo to see how you and your team can leverage SimpleLegal to gain total visibility into your legal spend.

This article has been updated to reflect new information and industry trends from the original article, published on December 20, 2019.