3 signs your legal department needs spend management software

Don’t avoid spend management software because you’re (understandably) concerned about the cost of investment. While new technology always comes with a price tag, whether or not the cost is justified depends on selecting the right technology that provides a clear return on investment – as quickly as possible.

Legal spend management software exists to give you better control over and visibility into your legal spend. When you replace manual, outdated processes with a system that allows you to work more efficiently and save money, the software ends up paying for itself.

If any of the following situations ring true for your organization, it’s time to invest in spend management software.

1. Your Invoice Process Is Highly Manual

Think about how your legal department currently handles invoices. Do you have a set process? Whether it’s completely manual or partially managed with technology, there are many signs that indicate a need for spend management software.

If your current process relies on individuals to move invoices through the approval process, then silos and delays are inevitable. All it takes is one person going on vacation to get an invoice buried in an inbox. And the more complex the approval workflow, the higher the risk of delays. For instance, if you set spend thresholds that require your chief financial officer (CFO) to sign off on invoices above a certain amount, you’re completely at the mercy of your CFO’s schedule.

In the best case scenario when everyone works quickly, manual invoice workflows force skilled professionals to waste hours on admin work. And, without the right technology, your team has to scramble to figure out where an invoice is in the process. Do you really want to parse through a long email thread to figure out where an invoice is held up? When you can’t easily monitor the lifecycle of an invoice, you’ll spend a lot of time and energy on back-and-forth communication with both your internal team and outside counsel.

Discounts and alternative fee arrangements (AFAs) often fall through the cracks as well. Without spend management software, you don’t have spend visibility to verify that preferred panel rates, volume discounts, and AFAs are honored. In some instances, rates are negotiated by the matter lead and those approving may not be aware. You risk overpaying simply because you don’t have a reliable and streamlined process that involves the right people in the process at the right time.

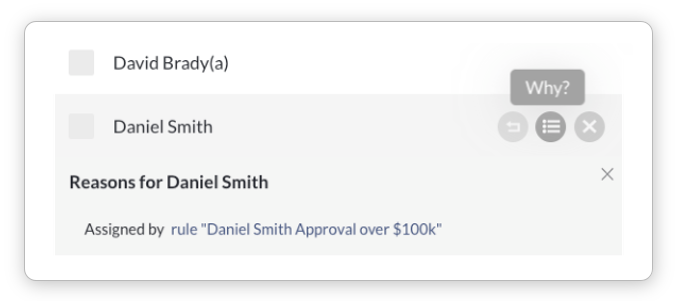

Spend management software automates the many parts of the invoicing process. Automated approval workflows eliminate silos and give you full visibility into the life cycle. SimpleLegal’s spend management platform even has a “Why am I here?” feature that tells each invoice approver why an invoice requires their sign-off.

You can use spend management software to automate legal billing guidelines enforcement too. If an invoice includes unauthorized UTMBS task codes, doesn’t honor an AFA, or deviates from the guidelines in any way, spend management software will flag it. From there, the system can reject the invoice outright, adjust it to the proper amount, or route it to someone for manual review.

2. You Don’t Have a Way to Track and Manage Unbilled Estimates

According to our internal study, there’s a 26% discrepancy between accrual estimates and the amounts that law firms actually end up charging. If you’re not using a spend management solution for accruals management, you may end up paying hundreds of thousands of dollars more than planned every month. It’s a terrible way to budget and it’s sure to create friction between your legal department and finance.

Your team probably works with quite a few outside law firms. How many of them actually respond to your requests for unbilled estimates? In our study, it was less than half. And those responses don’t come easily — legal ops teams normally have to follow up multiple times.

Now think about what happens when you receive an invoice seemingly out of nowhere. You think a five-month-old project is over and done with, and then a six-figure invoice shows up. But how do you prevent outside counsel from submitting invoices past the agreed-upon billing period or make sure late invoices are rejected? Without a tracking system, late invoices can slip right by and completely throw off your monthly budget.

Manual processes make comparing unbilled estimates to actual amounts invoiced arduous as well. Let’s say an outside firm sends an invoice that’s 20% higher than estimated. Finance and accounts payable may simply absorb the additional costs instead of investigating the gap. Not only are finance and accounts payable departments too far away from the legal work to know what is and is not acceptable, they often don’t have the time to dig into the details.

Spend management software makes closing that gap much simpler. You can automate requests for unbilled estimates and track accruals from estimates all the way to the final invoice. What’s more is that the system collects all of the data around unbilled estimates, allowing you to report on which law firms are consistently inaccurate when it comes to identifying and billing for work in progress. It gives your team the opportunity to have data-driven conversations on how to remedy the issue, identifying which law firms can be strategically-minded long-term partners.

3. You Can’t Create Detailed Reports

In the past, legal departments operated with minimal oversight. Now, legal ops teams are expected to prove their value to the company as a whole. If finance asks your team for a detailed breakdown of legal spend over the last quarter, could you provide it quickly and easily? If not, it’s time for spend management software.

Manual spend tracking is inefficient and error-prone. Plus, you’ll have a hard time justifying spend and convincing higher-ups to approve budget increases if all you have are clunky spreadsheets.

Spend management software allows you to delve into the details. Instead of tracking only invoice amounts, you can break legal spend into categories such as law firm, practice area, and matter type. You can even track law firm performance over time, so you can make more informed staffing decisions in the future.

Robust reporting is crucial for legal departments that want to make data-driven decisions. With SimpleLegal’s spend management platform, custom reports are only a few clicks away.

How Much Could Spend Management Software Save You?

Legal departments are accustomed to working with outdated legacy systems simply because that’s what’s familiar. But those outdated systems cost you more than you’d think. Every legal ops teams needs real-time visibility into every aspect of legal spend. If you can’t produce a spend analysis on-demand, chances are you’re overspending without realizing it.

Still not sure if you’re ready for the investment? Use our free savings calculator to get an idea of how much you could save by upgrading your current system.