M&A legal fees: 3 areas that rack up costs and how to keep fees low

Legal fees are among the top costs in mergers and acquisitions (M&As): where an accounting firm may charge up to $75,000 to advise in an M&A transaction, a law firm may charge more than $100,000. But while M&A legal fees are high, the cost of no or poor legal guidance is far higher. Mergers and acquisitions are complex business transactions that can go wrong without proper legal guidance. Your private equity firm may end up with an intellectual property lawsuit that invalidates your new acquisition or a complication with employee benefits. Proper legal guidance helps you predict and prevent these kinds of issues down the road.

But does that mean you should be resigned to high and unpredictable legal fees for M&As? Not necessarily. You can keep M&A legal fees low when you proactively manage negotiations at the letter of intent (LOI) stage, in addition to managing legal due diligence and drafting and negotiating deal documents. Here’s everything you should know!

1. Negotiating the letter of intent

A letter of intent (LOI) is the initial formal agreement between a buyer and a seller during an M&A that outlines key terms, including purchase price, deal structure, and contingencies. At this stage, lawyers help figure out the best way to structure the transaction so it is tax-efficient and without errors. They’ll check for problematic or unclear LOI terms and additional considerations that may or may not be binding. All of these can be time-consuming—and lead to lots of billable hours for your outside counsel.

It’s important to give this stage of an M&A deal all the attention possible because the more you negotiate at the LOI stage, the less you negotiate on the definitive documents in the future. There’ll be less hassle, disagreements, and room for unfavorable conditions from the other party when it’s time to draft the purchase agreement, merger agreement, and other documents to close the deal.

Negotiating an LOI typically takes 30 to 60 days, where lawyers go back and forth on drafts until the LOI is acceptable to all parties. Your attorney spends several hours going through this process to ensure the best outcome for you, which is why bills rack up at this stage.

How to manage M&A legal fees at the LOI stage

The best way to reduce costs during this stage is to negotiate discounts and alternative fee agreements (AFAs) like fixed or flat fees, task-based fees, and blended rates, which are more predictable. When you negotiate, focus on emphasizing the value of the lawyers’ work for your company rather than the time it takes them to complete it. That way, you can convince your vendor to assign low-value tasks to team members with lower hourly rates. Also, emphasize the benefits of discounts and AFAs for their firm (predictability in income, fewer disputes on invoices, and maybe more projects for them), so it looks like a win-win for everyone.

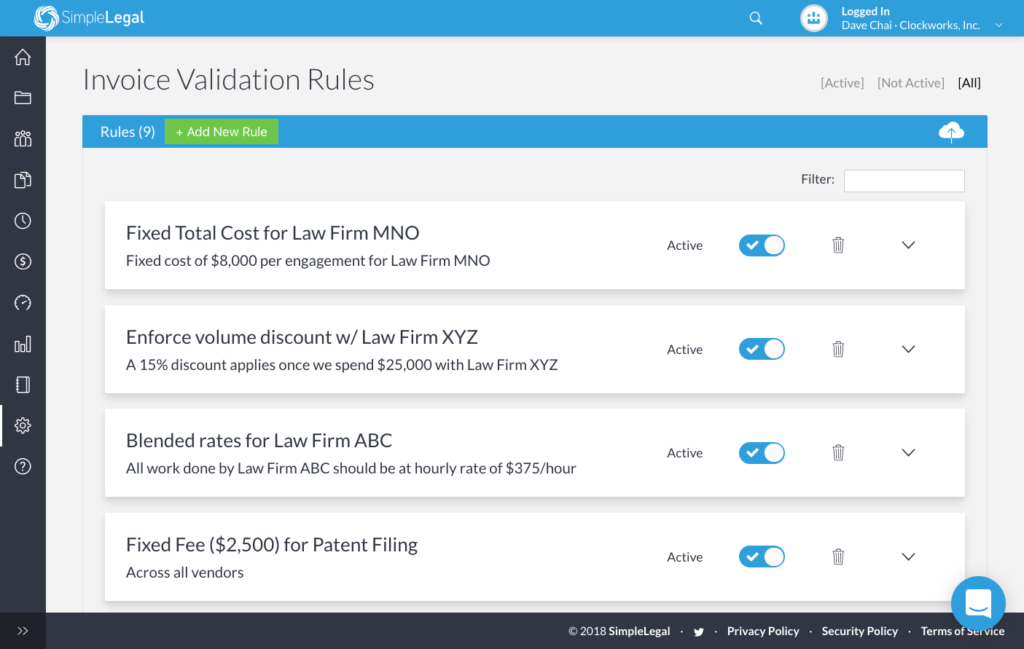

Another way to reduce costs during LOI is to monitor billing for inaccuracies. Double billing, padded hours, and other forms of overbilling are some of the biggest reasons for inflated legal invoices. Use a spend management solution like SimpleLegal to monitor for billing inaccuracies, as well as track and enforce discounts and AFAs.

2. Performing legal due diligence

Legal due diligence is the stage in an M&A where lawyers assess the legal risks associated with a deal by collecting information from documents like the certificate of incorporation, limited liability agreements, stockholder agreements, and so on. This process can take up to several months and many attorney hours on the clock.

This stage of an M&A is important because the information gathered during the process indicates how risky a deal is. That information can also support your terms in negotiations. For example, if a deal turns out to be riskier than a seller suggested—maybe you find evidence of tax evasion—you could use that as leverage to bring down the valuation and purchase price of the deal to account for that risk.

Legal due diligence racks up costs because it is a time-consuming process that can take up to several months, leading to more outside counsel hours on the clock.

How to manage M&A legal fees at the due diligence stage

The best way to keep costs low during due diligence is to limit what outside counsel handles during the process and agree on a scope to cover before you get started. Rogier van Bijnen, director at R&P China Lawyers, explains, “Agreeing on a scope of work—like setting a maximum number of contracts to be reviewed, or to exclude tax and insurance issues…— can get you a fixed fee or capped fee structure, which is more predictable.”

Sometimes, to keep costs low, you may be able to use industry-specific specialists. For example, you could contract benefits consultants to take a look at the benefits plans instead of having a lawyer do it. Internal staff can help perform less intensive checks, too.

3. Drafting and negotiating the deal documents

Prior to the signing or closing of an M&A deal, lawyers need to draft and negotiate deal documents, “including the main purchase or merger agreement (typically ranging from 50-120 pages) and often ancillary agreements, such as employment agreements and escrow agreements,” according to Maria Granholm, special counsel at Duane Morris LLP. This stage racks up costs because lawyers bill several hours for negotiating with the counsel on the other side, reviewing the details of the agreements, and explaining contract details to your team.

These agreements need to be drafted carefully in order to memorialize the business understanding between both parties, as well as the consequences for any violation. Every term needs to be clear and admissible in court.

How to manage M&A legal fees at the drafting and negotiating deal documents stage

Here are some ideas to keep M&A fees low at this final stage:

- Keep a steady pace. “Accelerated timeframes can increase the legal fees because more lawyers are involved and each needs to bill for their hours. Lingering deals can also cost more. A steady pace is most cost-efficient,” notes Granholm.

- Educate your entire team on your own. Learn all you can about the process on your own and spend time educating your team, so lawyers spend fewer billable hours educating you. Here’s a good course from Lawline to get you started.

- Comprise your lawyer deal team with people at varying levels of experience. “Don’t pay a partner $1,000 per hour to look at closing certificates; a job that can be done by an associate equally well if not better because they see that type of work more frequently,” says Granholm.

- Create billing guidelines that clearly state how your vendors should work with you. These guidelines can include timekeeper roles and staffing expectations, how vendors should submit invoices, and when payment will be made. Further, use an e-Billing platform like SimpleLegal to make sure your vendors follow them rather than trying to enforce guidelines manually. You’ll save costs and time and maintain accuracy.

Better manage M&A legal fees with spend visibility

M&A legal fees tend to be high, and sometimes the figures on the final invoice are a surprise. You can reduce the chances for surprises when you proactively manage the M&A process and the associated spend.

SimpleLegal’s spend management solution gives you full visibility into your legal spend. Sign up for a demo to learn how a platform like SimpleLegal can be used to monitor outside counsel billing for inaccuracies and enforce AFAs and discounts to reduce M&A legal fees without reducing the quality of legal services.